Capital gains tax on investment property calculator

Again the tax rate is determined by your total income and filing status. Build Your Future With a Firm that has 85 Years of Investment Experience.

Free Investment Property Calculator Excel Spreadsheet Investment Property Spreadsheet Template Excel Spreadsheets

The tax rate you pay on long-term capital gains can.

. Rhi buys an investment property for 500000 and sells it 5 years later for 600000. Use our Capital Gains Tax calculator to work out what tax you owe on your investment. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

However you can avoid using indexation while computing capital gains from equity shares and mutual funds and you are. Tax payable 20 of 1370000 274000. Tax rate on LTCG.

Ad AARPs Calculator is Designed to Examine the Potential Return From an Investment Property. The rate of CGT that you pay each year depends on the asset youve sold and how much you earn overall. Sale Proceeds Cost Base Capital Gain x 50 Taxable Capital Gains For example if your capital gain amounted to 72000 at the CGT event and youve held the property for four years.

For tax saving purpose have a investment property more than a year saved a lot tax. Calculate The Difference Between Cost Base and Capital Proceeds. Investors who hold onto an investment property for longer than a year can take advantage of long-term capital gains taxes.

These gains are generally taxed at a lower rate of. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. For this tool to work you first need to state.

2022 Capital Gains Tax Calculator Use this tool to estimate capital gains taxes you may owe after selling an investment property. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. This handy calculator helps you avoid tedious number.

Elaine is a single-filing taxpayer with an annual income of 100000. Application used to calculate how feasible your next investment property development is. To calculate capital gains youll first have to determine your assets basis or the price you paid.

Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. Invest in Silicon Valley Real Estate. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Capital gains are taxed at the same rate as taxable income ie. Step 3 is you then calculate the difference between your cost base and your capital proceeds to work out what.

If you earn 40000 325 tax bracket per. Capital Gains Tax Calculator Values. Calculate true profit an your.

You cannot use the calculator if you. 12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains. Capital gains taxes on assets held for a year or less correspond to.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. In the example above if you just earned 85000 a. Defer taxes with Flocks 1031 DST fund.

Using the steps above Rhi works out her capital gain as follows. Invest in Silicon Valley Real Estate. This is why the calculator asks for your taxable income.

Retire from being a landlord. Property Can Be an Excellent Investment. Using the example above lets calculate the capital gains taxes on Elaines investment property.

Heres how to find the total tax on the investment gain using the tax bracket reference above 89075-5000022 100000- 89075-5000024 and if you have really big gains. Work out if you need to pay. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

Ad Transform your real estate into a managed portfolio of single family homes. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. GST and Capital Gains tax Liabilities.

Calculate Understand Your Potential Returns. This means a large capital gain can push you into a higher tax bracket. She has no other capital gains or losses.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Realty Finance Articles Rera Rules Rera News Rera Compliances Rera In India Rera Calculator Where To Invest Investing Capital Gains Tax

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Calculator 2022 Casaplorer

Lzbw6a1vckffem

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

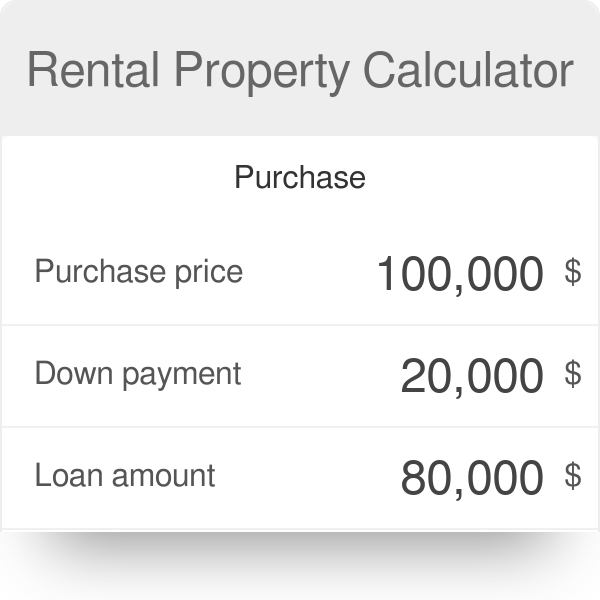

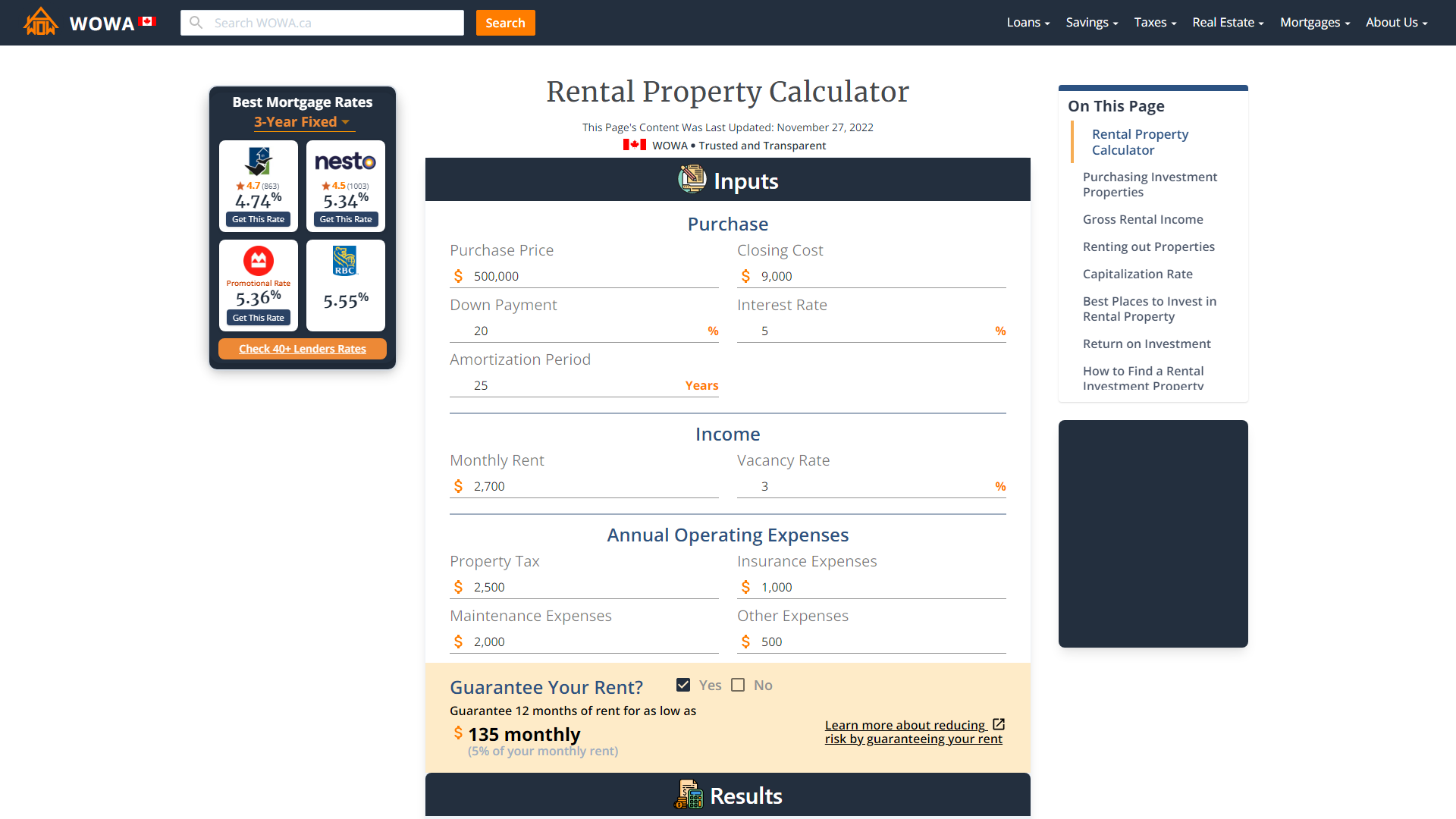

Rental Property Calculator How To Calculate Roi

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Iqexxkzshldbom

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

Mutual Fund Taxation Factors Mutuals Funds Capital Gain Capital Gains Tax

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Rental Property Analysis Spreadsheet